mississippi income tax brackets

Box 23050 Jackson MS 39225-3050. View The Income Tax FAQ.

Tracking Graduated Income Tax History Republic Times News

Read the Mississippi income tax tables for Single filers published inside the Form 80-105 Instructions booklet for more information.

. Mississippi personal income tax rates. The following three years the 5 bracket will be reduced to 4. These rates are the same for individuals and businesses.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Reduce state income tax revenue by 525 million a year starting in 2026. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022. If youre married filing taxes jointly theres a. Mississippi has enjoyed robust tax collections the past several months partly because of increased federal.

The legislation contains language that the plan will be examined by 2026 with an eye toward personal income tax elimination. Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets. Filing Quarterly Estimated Taxes.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. The Senate voted 39-10 to pass the measure on Sunday with five Democrats joining the Republican majority in favor. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

The tax brackets are the same for all filing statuses. After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers. Mississippi also has a 400 to 500 percent corporate income tax rate.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. The following three years the 5 bracket would be reduced to 4.

After the first year the tax-free income levels will be 18300 for a single person and 36600 for a married couple lawmakers said. Ad Compare Your 2022 Tax Bracket vs. All other income tax returns P.

Box 23058 Jackson MS 39225-3058. Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. If you are receiving a refund PO.

Another day another tax cut proposal in Mississippi Legislature. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent. Mississippi has a graduated tax rate.

4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. 2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Your 2021 Tax Bracket to See Whats Been Adjusted.

This income tax calculator can help estimate your average income tax rate and your salary after tax. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. South Carolina Income Tax.

Wisconsins 2022 income tax ranges from 4 to 765. Any income over 10000 would be taxes at the highest rate of 5. Social Security.

There is no tax schedule for Mississippi income taxes. Single married filing separate. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Learn More About Income Taxes. Starting next year the 4 income tax bracket will be eliminated.

3 rows Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax. Mississippi State Personal Income Tax Rates and Thresholds in. E-File With Income Tax Software.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Mississippi State Personal Income Tax Rates and Thresholds in. How Marginal Tax Brackets Work.

The graduated income tax. The plan would immediately eliminate the 4 tax bracket starting in 2023 at a cost of about 185 million to the state budget and then over the next three years step down the. Discover Helpful Information and Resources on Taxes From AARP.

The House passed the measure 92-23. Here is information about Mississippi Tax brackets from the states Department of Revenue. Arkansass top individual income tax rate declined from 59 percent to 55 percent as a result of legislation passed during the states December 2021 special session.

4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax.

Last Week We Published A Map Showing How Far 100 Would Take You In Different States For Example In States With Low Costs Of Li Map Economic Map What Is 100

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Historical Maps

Congress Readies New Round Of Tax Increases

Bad Map Example No Normalization And Too Many Colors And Categories Income Tax Map Amazing Maps

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

State Tax Levels In The United States Wikiwand

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Report Shows Mississippi 7th Highest In State Local Tax Burden Mississippi Politics And News Y All Politics

Kiplinger Tax Map Retirement Tax Income Tax

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Timeforchange Arizona Rfaz Ld24 Ld24dem Azdem Azdems Community Bestofphoenix Melrosedistrictphx Melrosephx V Kentucky Time For Change West Virginia

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

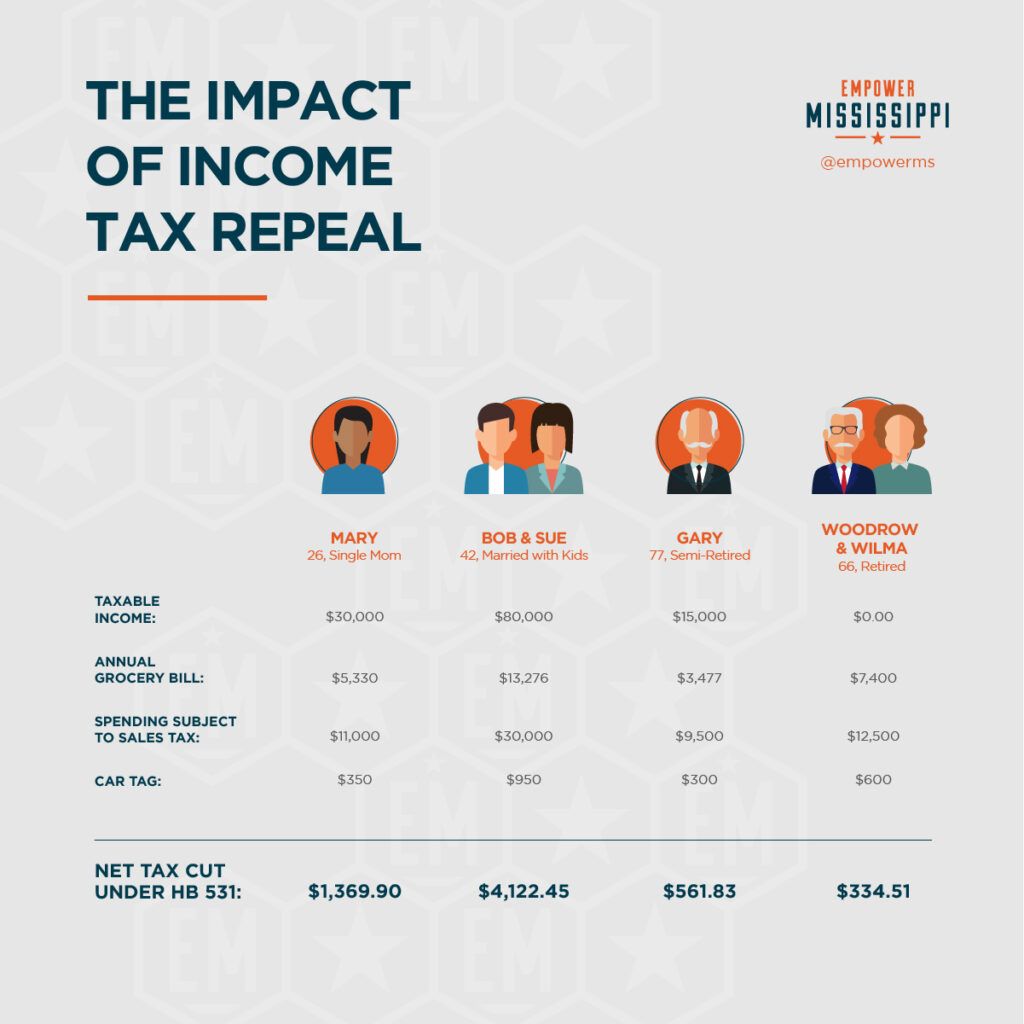

How Would Income Tax Repeal Impact You

Graph Showing How Much Minimum Wage Earners In Each State Would Pay If A Single Co Pay Took As Many Hours To Earn As A Co Pa Up Government Doctor Visit Medical

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Full Page Layout For Kiplingers Personal Finance Magazine Illustration Doodlesandstuff Andrewjoyce Illustrator Illustrated Drawing Procre イラスト イラストレーター